Common Errors That Could Get You First Time Filers In Tax Problems

If this year is the first time you will be filing a tax return, it is important to plan ahead of time. Mistakes are common among first-time filers, and those

If this year is the first time you will be filing a tax return, it is important to plan ahead of time. Mistakes are common among first-time filers, and those

Tax returns can be complicated and difficult to understand. Even for a professional, it can be hard to get every number and detail right. Often, you only notice the mistakes

Whether you are a professional gambler or a recent lucky starter, every gambler is fill with hope and excitement every time they walk through those casino doors. If you have

Most of our clients that come to our office with back tax problems are self- employed who had success business stories but due to a bad tax structure they end

Being self-employed carries a number of important benefits, from the ability to make your own hours to the freedom to work from virtually anywhere, especially during this time. But being

More and more people have been looking beyond the normal nine to five and making their own way in the world, creating an income they can rely on, one that

People often dream of leaving their jobs and going into business on their own so that they can pursue a passion and work without a boss. Self-employment can be a

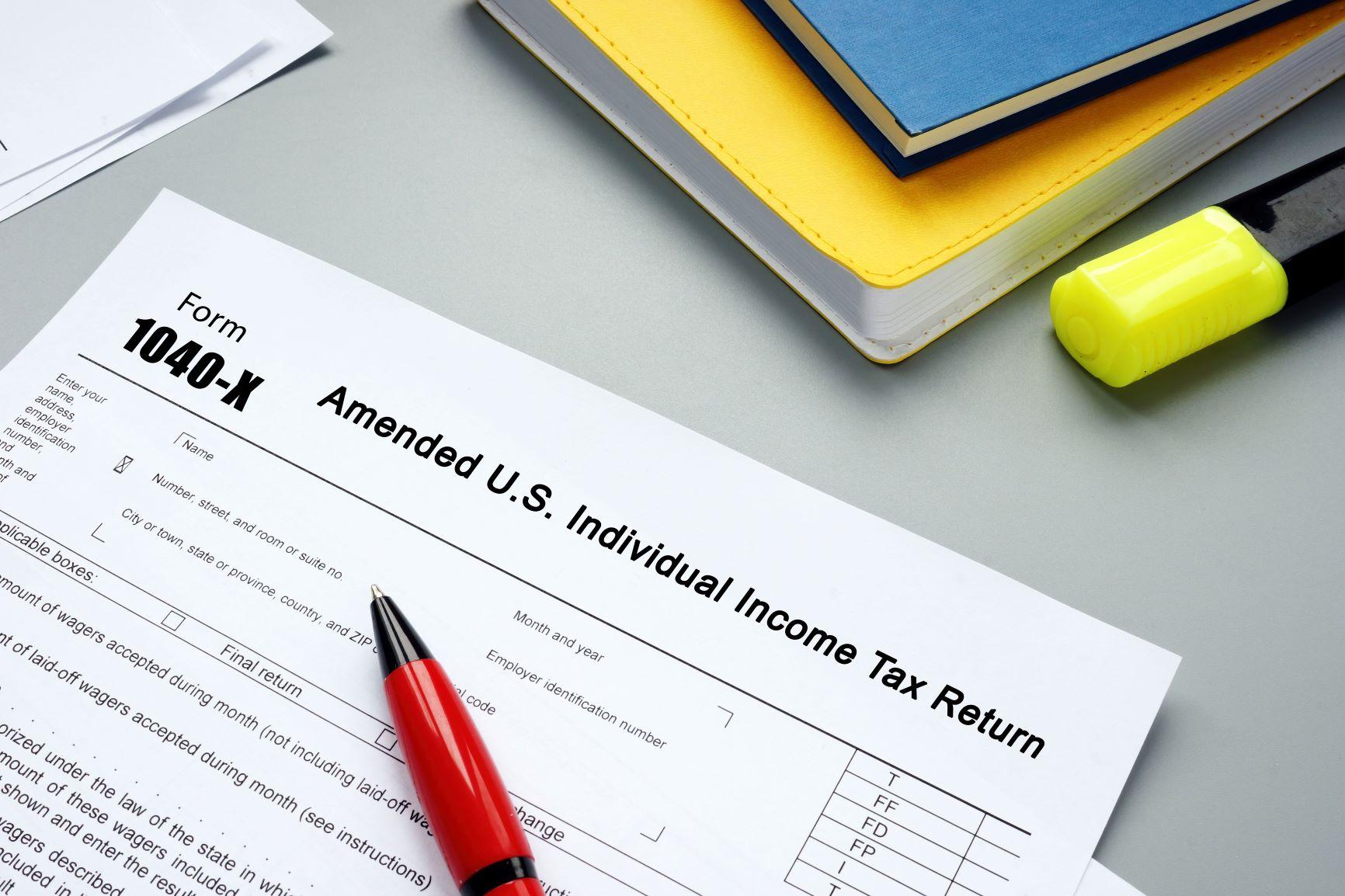

Tax returns can often be filed with incorrect or incomplete information, leading you to more tax problems. If you filed early, sometimes you might have overlooked income from a side

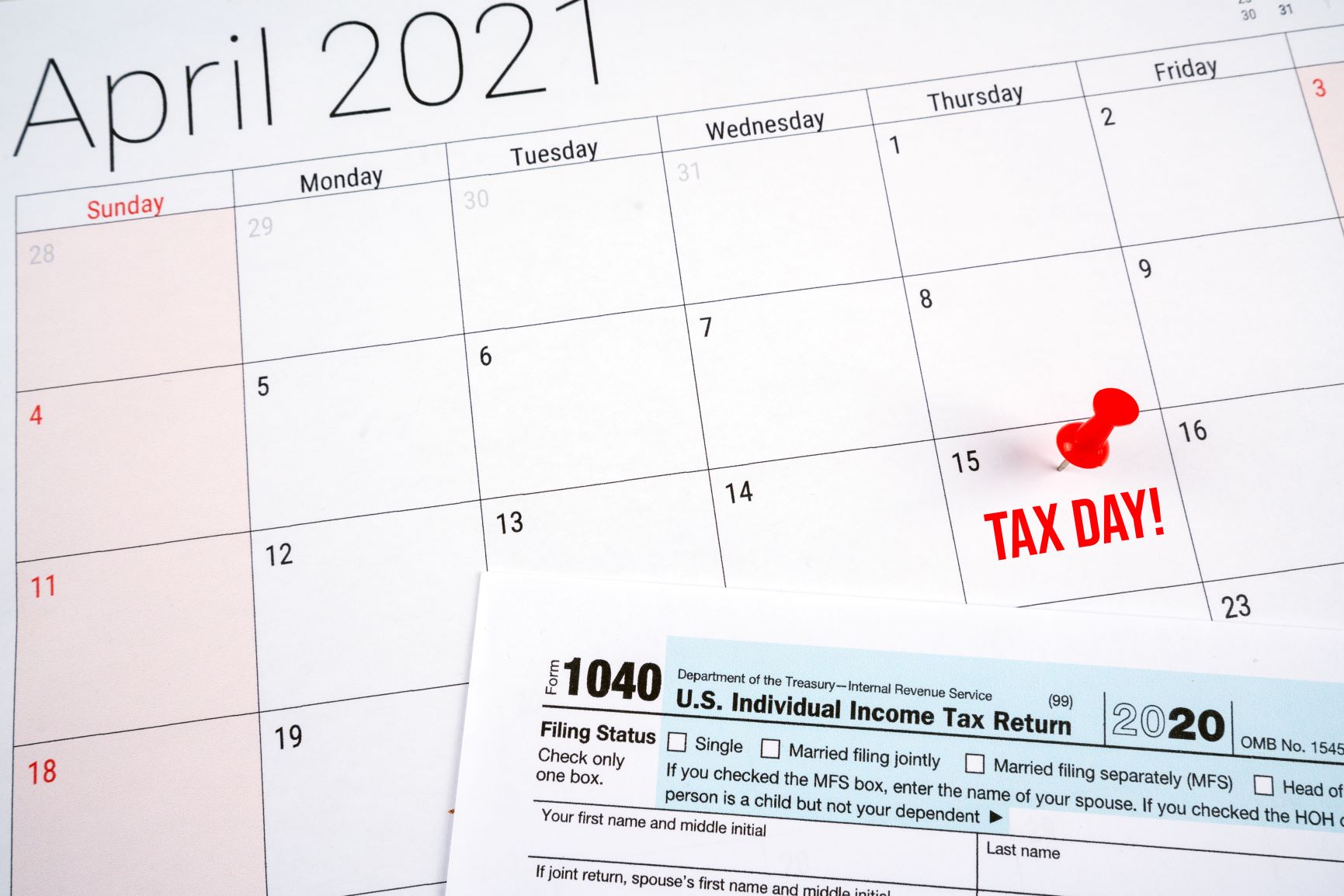

Tax filing season is probably the worst time of year if you are a procrastinator. With deadlines looming, filling out all those complicated forms and making sense of an increasingly

Tax identity theft occurs when identity thieves obtain your Social Security number and file a fraudulent tax return on your behalf with the intention of requesting a tax refund. According

© 2019 All rights Reserved Ramon Ortega CPA. Website powered by Centrix Corp.