Record Retention To Avoid Tax Problems Later

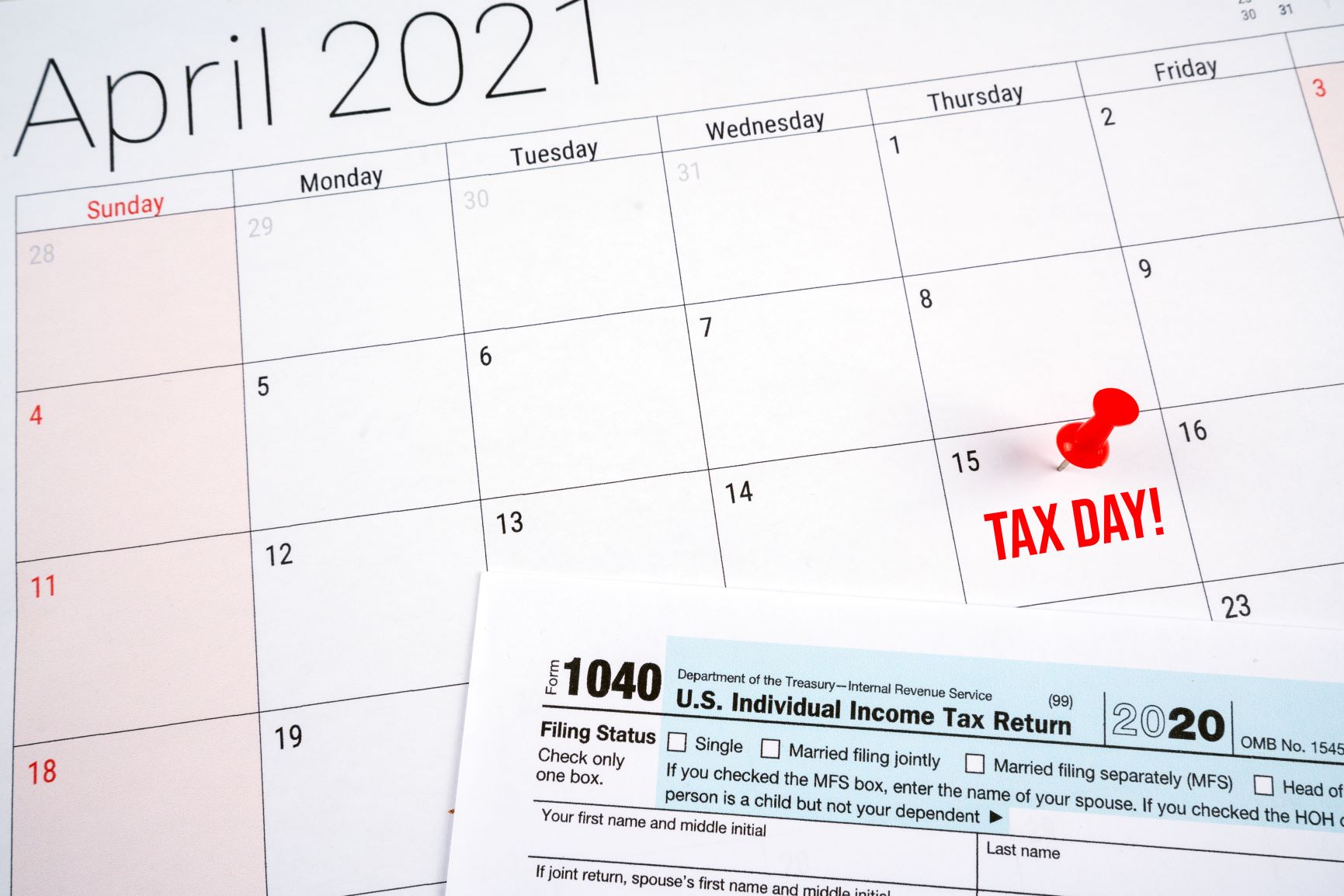

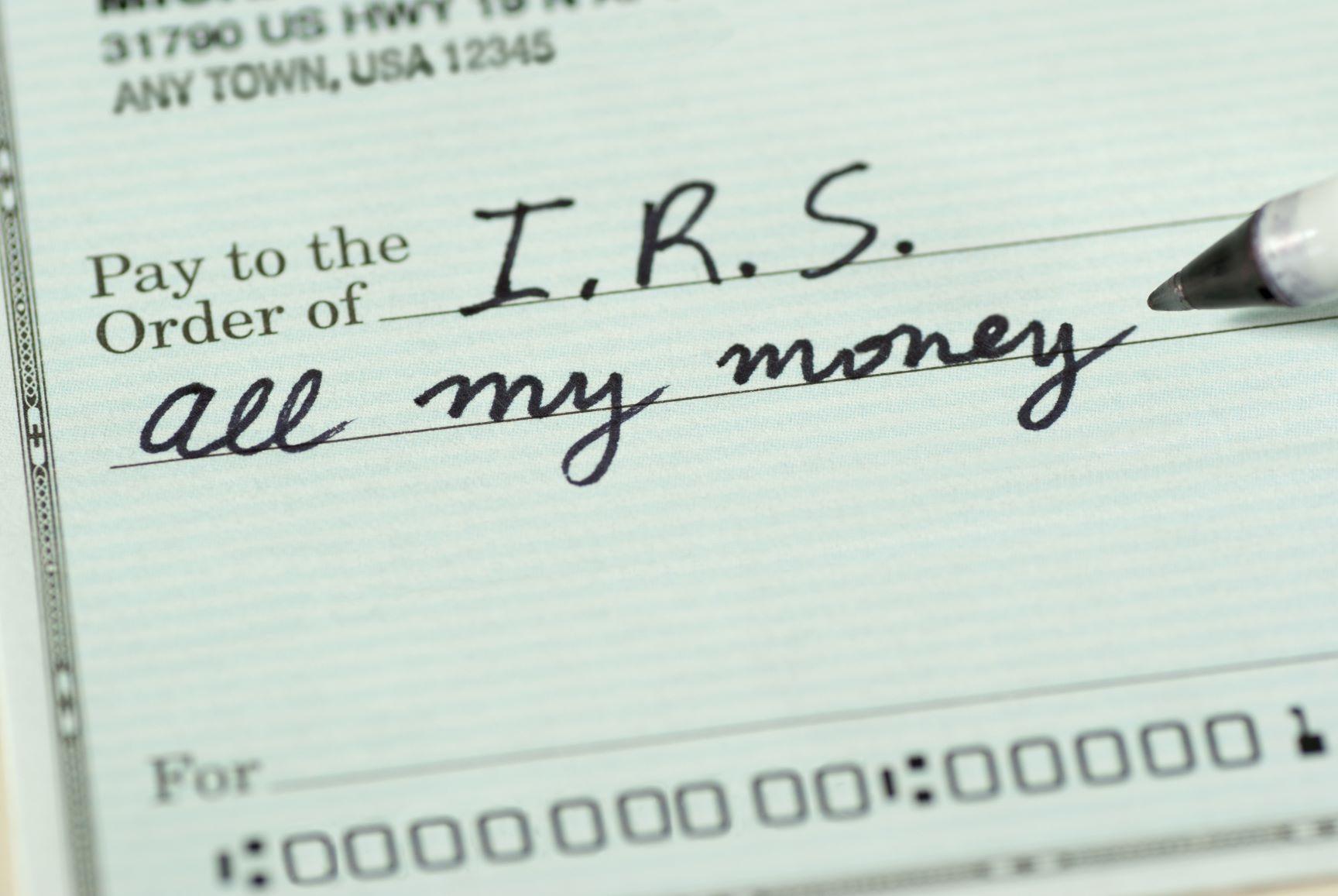

Whether you are expecting a tax refund or preparing to write a check, you know that April 15 is the annual tax filing deadline. What you may not know, however,

Whether you are expecting a tax refund or preparing to write a check, you know that April 15 is the annual tax filing deadline. What you may not know, however,

If you took on a side hustle last year to make ends meet and earn some extra cash, you may have found an unexpected surprise when you filed your taxes.

Proper tax planning is a year-round proposition, not last minute at the tax return season. You cannot afford to wait until taxes are due to start planning them and assessing

If this year is the first time you will be filing a tax return, it is important to plan ahead of time. Mistakes are common among first-time filers, and those

Tax returns can be complicated and difficult to understand. Even for a professional, it can be hard to get every number and detail right. Often, you only notice the mistakes

More and more people have been looking beyond the normal nine to five and making their own way in the world, creating an income they can rely on, one that

People often dream of leaving their jobs and going into business on their own so that they can pursue a passion and work without a boss. Self-employment can be a

Tax returns can often be filed with incorrect or incomplete information, leading you to more tax problems. If you filed early, sometimes you might have overlooked income from a side

Tax filing season is probably the worst time of year if you are a procrastinator. With deadlines looming, filling out all those complicated forms and making sense of an increasingly

Taxes are one of those subjects that people hate to talk or think about, especially if they anticipate owing money in back taxes every year. That’s probably the reason why

© 2019 All rights Reserved Ramon Ortega CPA. Website powered by Centrix Corp.