In response to the Coronavirus (COVID-19) pandemic, the U.S. Government through the Small Business Administration (SBA), the Internal Revenue Service (IRS) and the State of Florida through the Department of Economic Opportunity (DEO) have released different assistances programs for small business and individuals. CARES Act Assistance are available for business in Puerto Rico.

On March 27, 2020 the bill The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. Among the various federal and state assistance we would like to identify the following:

Small Business:

1) SBA Economic Injury Disaster Loan (EIDL) (also available for Puerto Rico)

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

Small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. This loan advance will not have to be repaid.

On April 13 the SBA released the following update:

“To ensure that the greatest number of applicants can receive assistance during this challenging time, the amount of your Advance will be determined by the number of your pre-disaster (i.e., as of January 31, 2020) employees. The Advance will provide $1,000 per employee up to a maximum of $10,000”.

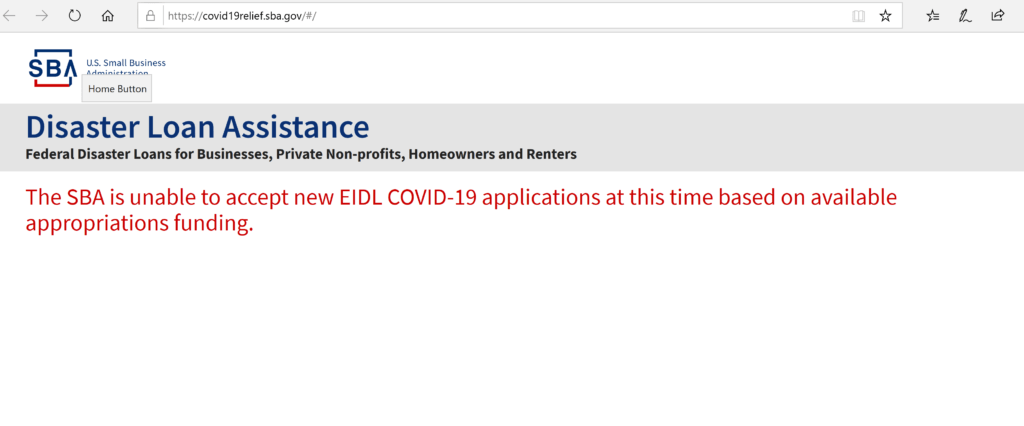

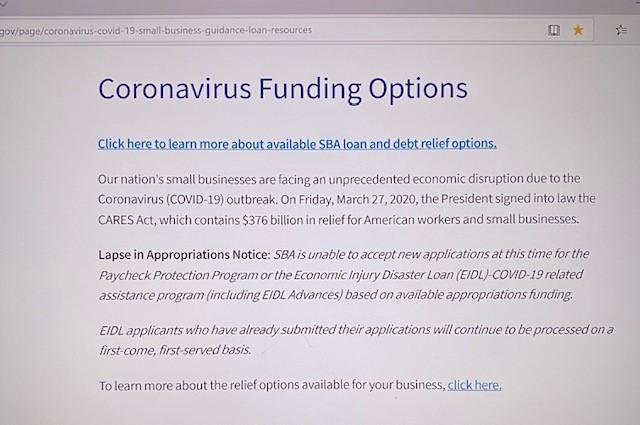

On the night of April 15, 2020 and as per the Small Business Administration (SBA) website, the Economic Injury Disaster Loan (EIDL) is not longer available for new applications based on appropriations funding.

On April 16, 2020, as per SBA website, besides the Economic Injury Disaster Loan (EIDL), the Paycheck Protection Program (PPP) is not longer available for new applicants due to lack of appropriations funding.

On Tuesday April 21 the Senate approved an additional $10 billion dollars funding for this program. The House approved the bill today (April 23) and now the bill goes for the President’s signature. President signed the bill on April 24.

As per the SBA, with the additional funding provided by the new COVID-19 relief package, they will resume processing EIDL Loan and Advance applications that are already in the queue on a first come, first-served basis.

They will provide further information on the availability of the EIDL portal to receive new applications (including those from agricultural enterprises) as soon as possible.

SBA opened their portal for new applications on a limited basis only on May 4, 2020. The limitation is for agricultural business only.

RECOMMENDATIONS

Remember that the process is on a first come, first serve basis. So you need to be ready and move fast.

If you haven’t applied before:

Be on the lookout when SBA opens their website to receive new applications. In the weblink you need to input company and owners information. Also, they will request the following financial information, so I suggest to have it prior to access the application:

1) Gross Revenue for the period beginning on February 1, 2019 thru January 31, 2020.

2) Cost of Goods Sold for the period beginning on February 1, 2019 thru January 31, 2020.

Be ready to submit the documents requested on the below paragraph (If you applied before).

If you applied before:

If you applied before and received a confirmation number, no need to do anything additional. If you received the advance, it means that your case is already under evaluation.

On the qualification process SBA will request the following documents:

- Income Tax Returns (business and personal)

- Personal Financial Statement

- Balance Sheet

- Schedule of Liabilities

- Forma 4506-T

It is to your advantage to have the information available so you can fill the documents when SBA contacts you. Remember: First Come, First Serve.

RECENT UPDATES

July 15: SBA opened the EIDL website today for new applications.

2) Paycheck Protection Program (PPP) (also available for Puerto Rico)

The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for everyone.

The following entities affected by Coronavirus (COVID-19) may be eligible:

- Any concerned small business that meet SBA’s size standards (either the industry based sized standard or the alternative size standard)

- Any business, 501(c)(3) non-profit organization, 501(c)(19) veterans organization, or Tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with the greater of:

- 500 employees, or

- That meets the SBA industry size standard if more than 500

- Any business with a NAICS Code that begins with 72 (Accommodations and Food Services) that has more than one physical location and employs less than 500 per location

- Sole proprietors, independent contractors, and self-employed persons

The loan amounts will be forgiven as long as:

- The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8 week period after the loan is made; and

- Employee and compensation levels are maintained.

This is an SBA Assistance program that you need to process through your lender.

Fintech Companies to participate in PPP lending to increase access to loans. The US Treasury has released a new lender application for non-bank lenders to increase the availability of loans. For those of you that had issues to apply due to the lack of lender relationship, you have additional choices to request the assistance.

This is the current list of FinTech companies that can also help you apply for these loans (in alphabetical order):

Biz2Credit

Cross River

Divvy

FIS

Fundera

Funding Circle

Kabbage

Lendio

Nav

OnDeck

PayPal

QuickBooks

Square

Stripe

Veem

We don’t promote any of them, suggest doing the proper research and make sure to access them through the proper website link.

On Tuesday April 21 the Senate approved an additional $300 billion dollars funding for this program. The House approved the bill today (April 23). President signed the bill on April 24.

SBA will resume accepting PPP loan applications on Monday, April 27 at 10:30 am (EST) from approved lenders on behalf of any eligible borrower.

RECOMMENDATIONS

Remember that the process is on a first come, first serve basis. Check with your lenders and FinTech companies since various of them had continue with the process waiting for the funding availability.

Information that they are requesting to support the process:

- Form 940 Employer’s Annual Federal Unemployment (FUTA) Tax Return (2019 For Business with payroll)

- Form 941 Employer’s Quarterly Federal Tax Return (1st Quarter 2020 For Business with payroll)

- Form 1099-MISC Miscellaneous Income (2019 For Self-Employed)

- Schedule C Profit or Loss From Business (2019 For Self-Employed) Could be a draft for those that hasn’t filed the 2019 return.

The Department of Treasury Released the Loan Forgiveness Application Form and Instructions (below).

The Treasury Department and Small Business Administration released two new interim final rules providing additional guidance regarding Paycheck Protection Program (PPP).

RECENT UPDATE

A new bill was signed (Paycheck Protection Program Flexibility Act) for the forgivable. Among various changes, now borrowers have the option to extend from eight to 24 weeks for the covered period. The 75% payroll requirement was reduced to 60%. Repayment period extended from two to five years.

3) Employer Retention Credit for Employers Subject to Closure due to COVID-19 (IRS) (also available to Puerto Rico)

Eligible employers may claim a refundable credit against the 6.2% (out of a total of 7.65%) of the employer portion of the FICA Tax for an amount equal to 50% of the qualified wages paid from March 13 to December 31, 2020 with respect to each employee.

To qualify for the credit, the employer must have been in operations during the calendar year 2020 and:

- Its operation is fully or partially suspended during the calendar quarter due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings due to the COVID-19 (“Government Order”); or

- The employer suffered a significant decline in gross receipts during the calendar quarter. It shall be considered that the employer suffered a significant decline in gross receipts if during any calendar quarter for the year 2020 the gross receipts of the employer are less than 50% of gross receipts for the same calendar quarter in the prior year. In this case, the credit may be claimed up to the calendar quarter that gross receipts are greater than 80% of the gross receipt for the same calendar quarter in the prior year or December 31, 2020, whichever is earlier.

Employers that were granted a qualified loan under the SBA’s Paycheck Protection Program (PPP) established under the CARES Act may not claim the credit.

Tax exempt organizations may claim the credit.

Frequently Asked Questions Employee Retention Credit under the CARES Act (IRS).

4) Short Time Compensation Program for Employers (Florida)

The Short Time Compensation program helps employers retain their workforce in times of temporary slowdown by encouraging work sharing as an alternative to layoff.

The program permits prorated reemployment assistance benefits to employees whose work hours and earnings are reduced as part of a Short Time Compensation plan to avoid total layoff of some employees.

The Short Time Compensation Program Goals are the following:

- Employees retained during a temporary slowdown can resume high production levels when business conditions improve and are spared the hardships of full unemployment.

- Employers avoid the expense of recruiting, hiring, and training new workers when business conditions improve.

- Employers who must permanently reduce their workforce can use the program as a transition to layoff. Affected employees may continue to work at reduced levels with an opportunity to find other employment before the expected layoff.

More Information and Employer Application Access

5) Florida Small Business Emergency Bridge Loan Program

The Florida Small Business Emergency Bridge Loan Program is currently available to small business owners located in the state of Florida that experienced economic damage as a result of COVID-19. These short-term, interest-free working capital loans are intended to “bridge the gap” between the time a major catastrophe hits and when a business has secured longer term recovery resources, such as sufficient profits from a revived business, receipt of payments on insurance claims or federal disaster assistance.

RECENT UPDATE

Not longer available due to lack of appropriations funding. Waiting on additional fund appropriations by the State of Florida.

6) Delay of Payment of Employer Payroll Taxes

This provision would allow taxpayers to defer paying the employer portion of certain payroll taxes through the end of 2020, with all 2020 deferred amounts due in two equal installments, one at the end of 2021, the other at the end of 2022. Payroll taxes that can be deferred include the employer portion of FICA taxes, the employer and employee representative portion of Railroad Retirement taxes (that are attributable to the employer FICA rate), and half of SECA tax liability.

Deferral is not provided to employers receiving assistance through the Paycheck Protection Program.

Individuals:

1) Direct Cash Payment

Every American with a valid Social Security number making less than $75,000 a year ($150,000 for married couples) will receive $1,200 each, and an additional $500 per child. Individuals earning between $75,000 and $99,000 a year, will receive a partial, phased-out payment. The phase-out is determined by reducing by $5 for each $100 that a taxpayer’s income exceeds the threshold. Your income levels will be based on your 2018 tax return, or your 2019 tax return if you’ve already filed this year. This payment is not considered taxable income. In general, a child is any dependent of a taxpayer under the age of 17.

The U.S. Department of Treasury is working on a web-based system for individuals to submit their current information for direct deposit payments. More information on this is expected soon. If you are currently receiving Social Security benefits, that payment information will be used for your direct payment.

The payments will be distributed based on information from your 2018 tax return, or 2019 tax return if you’ve already filed this year. The U.S. Department of Treasury is also working on a web-based system for individuals to submit their current information for direct deposit payments. More information on this is expected soon.

Non-Filers Only Additional Info and Enter Payment Info Here

Filers: Get Your Payment:

Use the “Get My Payment” application to:

- Check your payment status

- Confirm your payment type: direct deposit or check

- Enter your bank account information for direct deposit if we don’t have your direct deposit information and we haven’t sent your payment yet

On April 15, 2020 the IRS started the direct deposit of the individual stimulus.

RECENT UPDATE

IRS is working on various databases and they update the same once a day (at night). If you don’t see the status early in the day, don’t try until the following day.

2) Reemployment (Unemployment) Benefits (Florida)

Reemployment Assistance (also called reemployment assistance insurance) provides temporary wage replacement benefits to qualified individuals who are out of work through no fault of their own.

3) Pandemic Unemployment Insurance

The Pandemic Unemployment Assistance program provides payment to those not traditionally eligible for unemployment benefits (self-employed, independent contractors, those with limited work history, and others) who are unable to work as a direct result of the Coronavirus public health emergency.

The CARES Act provides an additional $600 per week to recipients of unemployment insurance or Pandemic Unemployment Assistance for up to four months, and an additional 13 weeks of unemployment benefits to those who need it.

Assistance information and application is also available in the same website for the Reemployment Benefits above.

4) Withdraws from Retirements & 401K’s

An individual could withdraw up to $100,000 this year without the usual 10% penalty, as long as it is because of the outbreak. This money could also be put back into the account before those three years are up, exempt from the normal rule prohibiting contributions that large.

This exception applies only to Coronavirus-related withdrawals. Individuals may qualify if they, a spouse or a dependent tested positive, or they experienced a variety of other negative economic consequences related to the pandemic. Employers could allow workers to self-certify that they are qualified to pull money from a workplace retirement account.

You could still borrow from your retirement plan and could take out twice the usual amount. For 180 days after the passage of the CARES Act, with certification that an individual has been affected by the pandemic, they would be able to take out a loan of up to $100,000. The rule usually prohibiting an individual from taking out more than half of their balance would be suspended.

The amount that they are excluding for taxes is the early withdrawal penalty. You should consult with your Accountant and Financial Advisor on your specific situation and the impact on such withdrawal.

5) Education Stabilization Fund

The Secretary of Education Betsy DeVos announced that all loan payments, principal, and interest due on Direct and Federal Family Education Loan (FFEL) student loans will be deferred for 6 months, through September 30, 2020, without penalty to the borrower.

The CARES Act ensures that students who drop out of school as a result of a qualifying emergency, can exclude the semester or term they were unable to complete from their federal academic requirements, lifetime subsidized loan eligibility, and/or their Pell Grant duration limit.

6) IRS Extended Tax Deadlines To Cover Individuals, Trusts, Estates Corporations and Others

To help taxpayers, the Department of Treasury and the Internal Revenue Service announced on April 9, 2020 that Notice 2020-23 (PDF) extends additional key tax deadlines for individuals and businesses.

Last month, the IRS announced that taxpayers generally have until July 15, 2020, to file and pay federal income taxes originally due on April 15. No late-filing penalty, late-payment penalty or interest will be due.

This notice expands this relief to additional returns, tax payments and other actions. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extra time. This means that anyone, including Americans who live and work abroad, can now wait until July 15 to file their 2019 federal income tax return and pay any tax due.

You should consult with your Accountant if the filing date was also extended for the state returns and requirements.

The information and links above are as of today (April 14, 2020), guidelines are changing quickly, I suggest that you keep posted on the different programs. Various of them are available on a first come, first serve basis, so I encourage you to benefit on them.

If you want to subscribe for our Newsletter, please sign here.

Stay safe!

Ramon